In the tech industry, understanding salary trends is crucial for professionals and employers alike. At Oliver Bernard, as a specialist tech talent partner, we have now been tracking salary benchmarks for half a decade. We asked Tom Nicholls, Associate Director at Oliver Bernard, with nearly three times that experience in .NET recruitment, to shed light on changes and shifts that have occurred in the .NET space.

Permanent .NET salaries on the rise

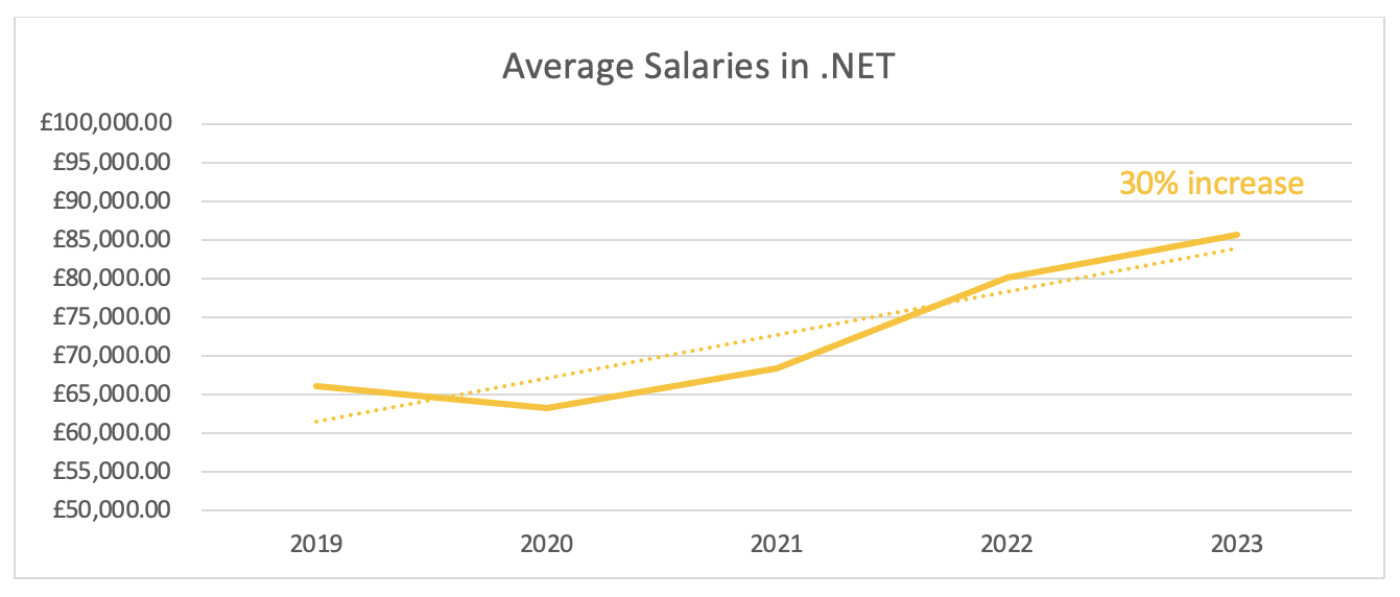

Over the last 5 years, .NET salaries have increased by 30%, over double the UK average. Notably, the tech salary bubble isn't exclusive to London; it's a phenomenon witnessed across various European tech hubs.

Traditionally we have seen wide salary variances between roles inside financial organisations, who paid the highest salaries, compared to other domains. Yet during the last 5 years I have seen the mantra tech is more important than domain take over. With the wealth of transferrable skills, domain experience can be much easier taught than the technical competencies required to master .NET, which has narrowed the salary gap across domains.

Factors Driving Salary Growth

Apart from organic salary growth, two major events have significantly impacted .NET salaries in the last 5 years. Firstly, in 2019, the influx of venture capital backing tech startups, resulting in the creation of unicorns like Trainline, propelled demand for .NET developers. To attract top talent, many companies that had an influx of funding began offering salaries up to 20% higher than the market rate in an effort to meet scaling targets. Secondly, as lockdowns were lifted towards the end of 2020, several tech companies resumed projects they had shelved during times of uncertainty. This resurgence led to a hiring surge and consequently drove up salaries for .NET developers.

Initially, many employers resisted increasing rates, but as job vacancies remained unfilled, they had no choice but to increase salaries to meet their development goals. Counteroffers became commonplace, marking an industry-wide change.

Contractor Rates and the Impact of IR35

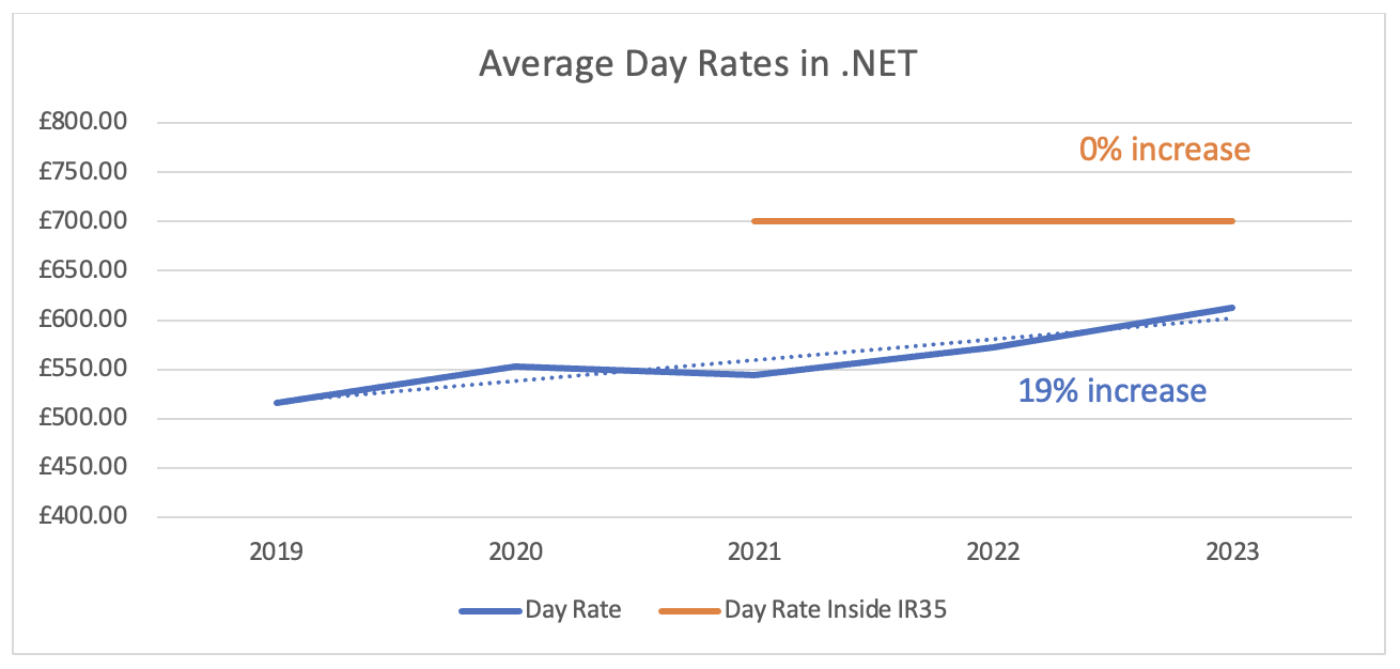

In the contracting space, there was an expectation that IR35 regulations would drive rates higher for roles within its scope. Indeed, during the initial months, day rates increased by as much as 40%. However, once the regulations settled in, this growth subsided to around 10%.

Over the last 5-years, the contractor salary trend has aligned more closely with the UK average of 14%. Interestingly, contractors who wish to maintain their Limited Companies and work as true freelancers are now accepting lower rates for contracts outside of IR35. In contrast, inside rates have stabilised and do not exhibit the same rapid growth witnessed in permanent salaries.

What Lies Ahead

Traditionally, our focus has been on mid to senior-level roles in the .NET space, as the skillset required was often beyond the reach of junior developers due to the associate costs of Microsoft licensing. However, the decision by Microsoft to make .NET open source in 2014 is already having an impact with more junior .NET developers on the market. We anticipate this will bring down the median average of the whole market perhaps bringing it closer to UK averages, whilst not necessarily affecting the mid/senior salaries and demand remains high.

You can see our full salary benchmarking document here, which covers not just .NET but the wider Software Engineering space, Data Science & Analytics, Architecture, DevOps & Infrastructure, Testing, Product, UX & Design, Project Delivery, Senior Appointments & Talent Acquisition. To find out more about the .NET hiring landscape, please get in touch here.